RICHMOND – Thursday morning, August 19 at 9:30, Virginia Governor Bob McDonnell addressed the joint Senate Finance, House Appropriations and House Finance Committees in Richmond. Below are the Governor’s remarks.

********

Thank you.

Chairman Colgan, Chairman Putney, Chairman Purkey, members of the General Assembly money committees, ladies and gentlemen: good morning.

As is the custom each summer, I come to provide a summary of the recently concluded fiscal year, and some thoughts on the challenges and opportunities that lie ahead.

Seven months ago we met in the State Capitol for my first Address to the Joint Houses of the General Assembly.

In my remarks I noted that, together, “…We must agree to put in place policies that will unleash the innovation and ingenuity of the people of Virginia, opening the way for a new era of prosperity and progress. It starts with policies to promote job creation and economic development.” The only difference between that time and today is the temperature outside. Our top mission remains the same.

Creating good jobs for our citizens and turning Virginia’s economy around are the twin objectives that guide our Administration.

The challenges are many.

While well below the national average, the unemployment rate in our Commonwealth remains unacceptably high at 7%, meaning nearly 300,000 Virginians are not able to find a job.

Credit is very tight, too many homeowners have mortgages that are under water, concerns of a double dip recession linger, the stimulus bump is about over, and some federal policies and regulations have stifled business development.

In this tough environment we must remain fiscally conservative, embrace government reform, and look for more cost effective ways to deliver government services.

We live in a global economy. As we close the 2010 fiscal year and plan for the upcoming session, it is important to remember that we cannot control Greece’s credit rating, the buying power of China’s middle class, Singapore’s innovation, or Iceland’s solvency. However, we can control the steps Virginia takes to compete and succeed in the global marketplace. So on the mission of seizing control of our fiscal responsibilities and managing our resources with good stewardship, we have reason to be pleased with some of the progress that has been made.

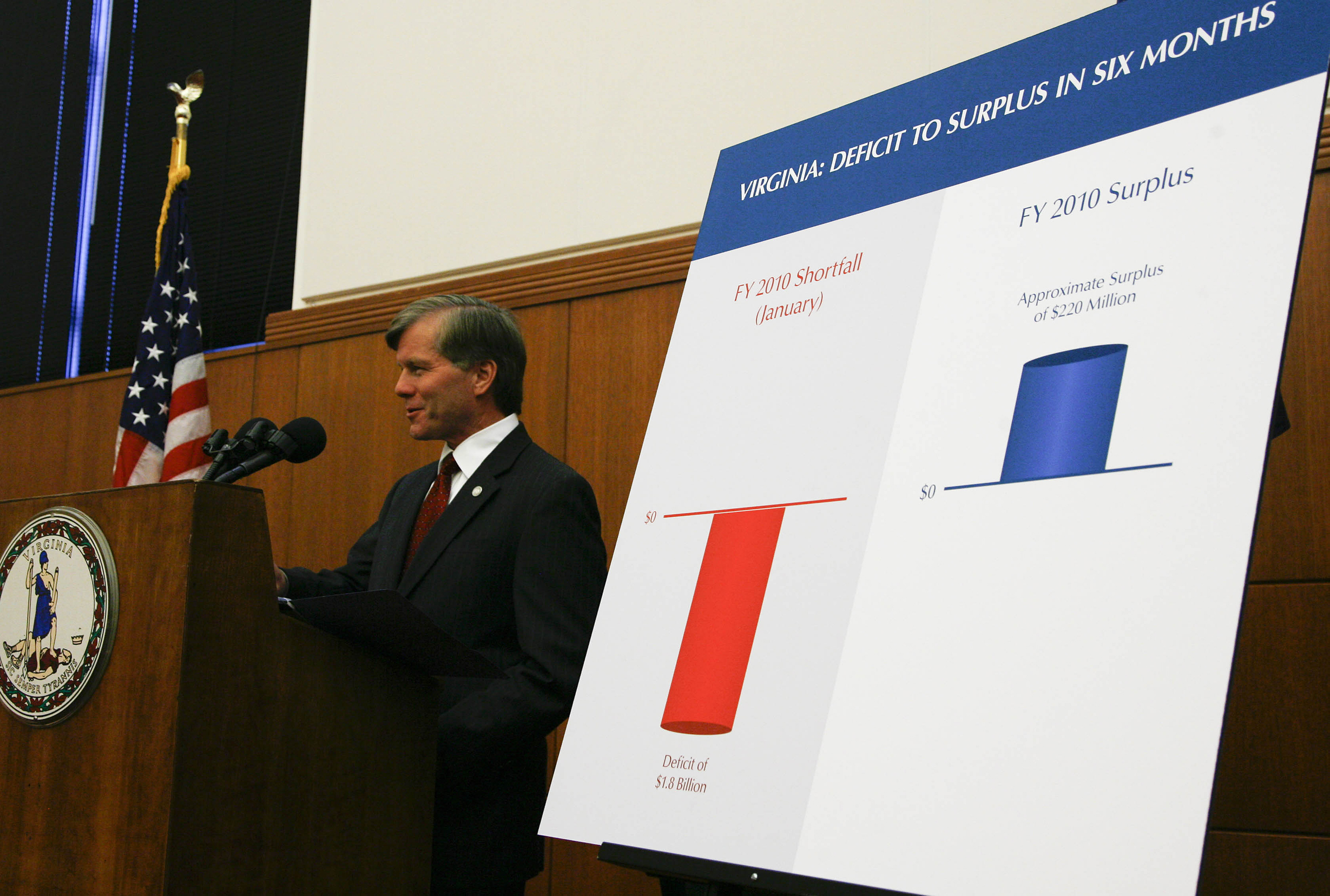

Last session we faced a potential $1.8 billion shortfall in the remaining FY 2010 budget. Today I am pleased to report that we closed the fiscal year with a $403.2 million surplus. We collected $228 million more in revenues than expected and spent $175 million less than budgeted. But please don’t get too excited, most of it is already obligated in statute or in the budget to meet various needs.

This modest surplus and fiscal turnaround was achieved by two Administrations, two houses of the General Assembly, and two political parties.

I applaud former Governor Tim Kaine for the tough cuts he made in this budget prior to leaving office. Governor Kaine also exercised conservative judgment in his revenue reforecast in December. Our Administration continued that policy of restraint during this session.

With a politically divided General Assembly, nothing meritorious is possible without bipartisan cooperation. The spending cuts and fiscal discipline that led to this surplus were the result of tough negotiations and agreement between a Republican House and a Democratic Senate. Thank you for your leadership and cooperation in this endeavor.

We have seen some slight economic growth recently in the Commonwealth. I thank Virginia’s business owners and entrepreneurs for their willingness to take risks in a tough economy. Those risks are paying off in the form of new jobs and increased tax revenue.

The other side of the surplus is found in savings. Virginia’s dedicated state employees deserve credit for their efforts to save nearly $175 million in tax dollars at the end of the fiscal year, rather than spending their budgets down to zero. Our managers found savings, and the Cabinet found smarter ways to do business, adhered to our hiring freeze, and brought in strong leaders.

Of the $228.5 million collected above the official forecast for general fund revenues and transfers, individual non-withholding payments and corporate income tax payments accounted for $169 million of that total. In addition, withholding and sales tax collections, which are directly tied to economic activity in the Commonwealth, exceeded the forecast by $62 million. This revenue growth occurred in the last four months of the year, beginning in March.

Our consensus revenue forecast process, which included the input of business leaders and General Assembly members, emphasized the need for caution and established the outlook for fiscal year 2010 at a level consistent with the lower growth forecast, which Governor Kaine built into the introduced budget.

In addition, during the midsession review, we held the line on revenue projections and your prudent actions enhanced our results.

Let me note briefly what did not contribute to these results.

The surplus did not come from the accelerated sales tax. Revenue from that policy, first enacted in a different form by the General Assembly in 2009, was already built into the revenue forecast in the budget, and actually came in slightly less than anticipated. I do not like the policy of the accelerated sales tax. It is an unfair imposition on Virginia’s retailers. This spring I sent you budget amendments to begin to phase out this policy by the end of my Administration, and I appreciate your approval of this request. Further, the revenue surplus is not tied to the deferral of payments to VRS. VRS rate reductions are part of the FY 2011/2012 budget.

Despite the growth during the last quarter of fiscal year 2010, total general fund revenues still declined in fiscal year 2010. However they declined less than anticipated. While we had forecasted a 2.3% decline, the final figure revealed a decline of only 0.7%. This slight improvement is worth noting. But it does not erase the fact that this was the first time in history that general fund revenues declined two successive years. Clearly, while the fiscal year finished with some optimistic trends, we must budget conservatively going forward.

Let me now discuss the savings component of the surplus.

Today I can also officially report that $174.7 million remained unspent in agency general fund operating appropriations on June 30, 2010, excluding amounts otherwise mandated for reversion in the budget. This total is comprised of $103.6 million in mandatory reappropriations to the affected agencies, and $71.2 million in undesignated discretionary balances.

Together, the $228.5 in additional revenue plus the $174.7 million in savings equal a $403.2 million surplus. And that leads to the question you all have been asking: where does it go?

The majority of the money is pre-designated by the Appropriation Act or by the Code of Virginia.

I am pleased to report that $82.2 million of the revenue surplus will go to provide the general fund share of a one-time 3% bonus to state employees on December 1, an action we all agreed to in the budget last session. Our state employees have not received any increase in pay since November of 2007. A prudent budget strategy we adopted was to incentivize state workers to generate savings and not spend their entire agency budgets by the June fiscal year close. Our employees knew there would be a financial reward for saving taxpayer dollars and returning unspent balances to the General Fund. I thank our hard working state employees, though there are fewer of them, for saving so much even after their budgets were reduced.

What this result also shows us is the power in economic incentives. This notion of gain sharing or economic rewards for getting results is a concept widely used in the private sector, and long overdue in practice and implementation within state government operations. I plan to look for more ways to use such incentives in the budget and amendments I submit to you in the coming years.

Another $36.4 million from the surplus is designated by statute for deposit to the Virginia Water Quality Improvement Fund to help with cleanup efforts of the Chesapeake Bay, for both point source and non-point source pollution. For the first time ever, $32.7 million will be set aside for transportation purposes as required in law by HB 3202 from the 2007 session, whereby two-thirds of all undesignated surplus balances go to transportation. This is a very small new investment in transportation, but it demonstrates what will be possible when better economic conditions return to the Commonwealth. I was also pleased that in May we issued for the first time nearly $500 million in transportation bonds authorized by HB 3202, and we will issue approximately $300 million annually during my time as governor.

Another $16.3 million will be slated for “nonrecurring expenditures” also pursuant to the provisions of HB 3202. This is the first time since FY 1999 that we had the equivalent of an undesignated fund balance for use in these types of investments.

The preliminary balance sheet for June 30, 2010 indicates that the Commonwealth ended the fiscal year with cash equivalent assets in the general fund of $872.9 million. This is the first time since June 30, 2007, that we have seen an increase in general fund assets from the previous fiscal year.

As I noted, this balance is largely committed already. Under current law:

- $295.2 million of this balance is reserved for the Revenue Stabilization Fund

- $132.2 million is already designated in the 2011-12 biennial budget

- $112.9 million is set aside to meet mandatory reappropriation of capital and operating amounts as specified in the Appropriation Act

- $69.9 million is slated for deposit or distribution to other accounts, (most notably $37.5 million to Communication Sales and Use Tax allocated to local governments and $27.7 million to the Transportation Trust Fund for its portion of the accredited sales tax receipts) and

- $23.1 million is reserved for the state’s share of obligations attributable to ongoing natural disaster authorizations.

The fact that we had sufficient resources to reserve for these items is, indeed, noteworthy. I will incorporate all of these actions into the budget recommendations I submit to you this December.

After providing for all of the aforementioned requirements or commitments, there is still a $71.2 million discretionary balance in the general fund as of June 30, 2010.

The Appropriation Act gives me until November 1 to make a determination about whether any of these balances should be retained by the affected agencies or spent on other priorities. I will also determine a recommended best use of the $103.6 million in reappropriations and $16.3 million in non-recurring expenditures when I submit budget amendments to you in December.

Finally, I am pleased to report that the good news in Fiscal Year 2010 is not limited to general fund revenue collections. In particular, the Commonwealth Transportation Fund (CTF) revenues exceeded the official forecast by $64.4 million in fiscal year 2010. That revenue surplus was attributable to solid growth in motor vehicle sales tax collections. New car sales increased by 4.2 percent and used car sales grew by 4.0 percent in fiscal year 2010, after falling by 27.5 percent and 10.8 percent, respectively, in fiscal year 2009.

Working together during this past General Assembly session, we made the very tough choices necessary to close an unprecedented $4.2 billion shortfall in the FY 2011/2012 budget through reducing spending, not increasing taxes. And we did it on time, in a bipartisan fashion.

We also made Virginia one of the only states to have already balanced a budget for FY 2012, the first year in which states will no longer receive Federal stimulus funding.

This current biennial budget brings our spending levels down to those of 2006. Just like families and businesses must operate in this tough economy, we had choices to make and priorities to set. Thank you for putting partisanship aside to put Virginia on a solid fiscal course moving forward.

One of the toughest choices we made in the FY 2011/2012 budget was to defer about $620 million in payments to our retirement system to avert further spending cuts. Pension solvency and security is a top concern and priority for me and most governors, and such actions are bad long term policy for our state employees. While our deferral is far less than those in other states, it is still significant money that must be paid back. I know we are all committed to paying at least the $74 million per year noted in the Appropriation Act, and as times allow, I will accelerate those repayments.

Another tough choice came in cuts to K-12 education. For the most part, public education was spared the budget cuts that were experienced by other state agencies in 2008 and 2009. Unfortunately, the current economic problems were so significant that many previously untouched programs could not avoid reductions in this current budget cycle. The easy cuts had already been made. Our main duty was to protect the dollars going directly to the classroom and we made decisions that minimized the impact there as much as possible.

As noted, the redirection in payments from the retirement system is not a permanent savings. However this budget action will allow localities to use the estimated biennial local VRS payment savings of approximately $627 million, along with $115 million of bond proceeds for education technology in the budget, and $123 million in federal recovery funds, to offset cuts made in the introduced budget and during the session.

Further, as a result of recent federal legislation, Virginia school divisions can apply for an estimated $249.5 million in additional assistance that was not accounted for in the budget. School divisions must use this money as required by law to retain, recall, re-hire, or even hire new staff to prevent any reduction in the quality of education services. In the future, I will ask that more money go to the classroom, where our children learn, not to bureaucracy and overhead.

It is important to note that when this $249.5 million is added to the resources previously mentioned from local VRS savings, bonds proceeds, and federal recovery funds, these new sources of support for education totaling $1.12 billion offset the major portion of the $1.22 billion in reductions made in Governor Kaine’s introduced budget and by us during the session.

Finally, school divisions were the first beneficiaries of today’s revenue surplus. A portion of the revenue surplus in 2010 was due to sales tax that supports public education. As a result, school divisions received $18.7 million in excess of the amounts originally designated for them with the checks sent in June.

While we have balanced our budget responsibly by making tough choices and not raising taxes, other states have chosen a different approach. Wisconsin, Massachusetts, California, New York and many others have chosen higher taxes as their solution to budgetary shortfalls. These choices have repercussions for future economic growth.

In this global and competitive economy, capital moves freely and quickly. A line on a map means nothing compared to the need to meet a bottom line. Employers have no hesitation in moving to states and nations in which they can be more productive, invest more aggressively, and innovate without excessive regulation, litigation and taxation.

Virginia is welcoming these employers.

In March, Mercury Paper left California to establish its North American headquarters in Shenandoah County.

In April, Fortune 100 Company Northrop Grumman followed suit, leaving Los Angeles for Fairfax County.

Phoenix Packaging Company chose Pulaski County for the site of its American headquarters. Virginia beat out Georgia, North Carolina, Kentucky, Tennessee and West Virginia to attract the South American manufacturer’s first North American facility.

All told there are 145 economic development projects, resulting in the creation of almost 8,000 jobs and over $1.18 billion in new capital investment, which the state has been a direct part of since January. I thank Lieutenant Governor Bolling, Secretary of Commerce and Trade Jim Cheng and my Senior Economic Advisor Bob Sledd for leading the job creation effort. There are significant new opportunities in the pipeline now.

During this past session of the General Assembly, we advanced a comprehensive economic development package of budget amendments and legislation to create jobs, attract new investment, and encourage existing businesses to expand their operations and increase their workforce in Virginia. You funded these economic development initiatives in the amount of $63.3 million. As of July 1st, we have increased the Governor’s Development Opportunity Fund, created investments in tourism and technology, begun the process to open overseas trade offices and implemented many other new incentives. I thank you again for giving me the tools to tell the Virginia free enterprise success story around the nation and the world to help create jobs for our people.

From February to June, Virginia ranked 3rd highest nationally in the total number of jobs created, trailing only Texas and Pennsylvania, and 4th highest nationally as a percentage increase.

Our statewide unemployment rate has fallen to 7.0%, which ranks Virginia the 12th lowest rate in the nation and the 3rd lowest east of the Mississippi behind only Vermont and New Hampshire. During these tough economic times, it appears that our business-friendly policies are bearing fruit as we fare better than most states. Virginia’s workforce remains one of the most diversified in the country, but workforce development remains a top priority to facilitate greater competitiveness in the growth industries of tomorrow.

Earlier this month, the Pollina Corporate 2010 rankings named Virginia as the “most pro-business state” in America, the fourth time Virginia has held this distinction. Last month, for the fourth straight year, CNBC ranked Virginia one of the top two states in the nation for business. In May, the U.S. Chamber of Commerce ranked Virginia 1st for cost-of-living adjusted median family income and 2nd for overall growth. These rankings matter. They tell employers big and small, domestic and foreign, that if they want to grow and to prosper they need to be in Virginia. Truly, the Commonwealth is “Open for Business.”

Looking ahead, here in Virginia, key economic indicators are expected to grow at a modest pace after the on-target performance in fiscal year 2010. In the official economic outlook for Virginia, employment is expected to increase only 1.1 percent in fiscal year 2011. Wages and salaries are expected to increase 3.0 percent. While this is positive, we must be aggressive in prudently managing our resources and apply our efforts to creating jobs to first sustain and then increase the numbers. I will meet with the Governor’s Advisory Council on Revenue Estimates and the Joint Advisory Board of Economists in the upcoming months to determine if any adjustments to our revenue projections for FY 2011 and 2012 are needed.

We know this economy will continue to be tough and uncertain. Many days our path seems to consist of a few steps forward, followed by several more back. Job losses have declined and the economy is beginning to create new jobs, but consumer confidence remains low and rural and inner city job opportunities are insufficient, particularly in Southern Virginia. The stock market has recovered from the lows of March 2009, but last week brought a string of negative days and a retrenchment to early summer numbers. Housing prices are starting to stabilize and sales have shown signs of recovering, but housing starts are at a historically low level. The benchmark barometer of the state of the national economy, the Gross Domestic Product (GDP), has increased for four consecutive quarters, but our trade deficit is near a two-year high. Just this morning, the Department of Labor reported that weekly jobless claims reached a nine-month high.

This uncertainty is exacerbated by an increased number of unfunded federal mandates accompanied by a finite supply of conditional federal stimulus and Medicaid funds. The level of Medicaid spending in the state is unsustainable, having grown 1600% in 27 years, and now consuming 20% of the budget and growing. We have unmet needs in transportation and higher education, and more investments in economic development tools are needed. All of this has a direct impact on our future budgeting and financial health.

Just last week, U.S. Secretary of Defense Robert Gates announced a proposal to close the United States Joint Forces Command in Norfolk and Suffolk. The Joint Forces Command continues to serve as a major employer of Virginians by directly employing nearly 5,000 civilians and service members. This decision will cost good quality, high paying jobs for thousands of Virginians, and I believe is a short-sighted action which ignores the need to maintain our joint interoperability capacity which is critical for American superiority in modern warfare.

Virginia teamwork was evident in the bipartisan state and congressional cooperation on this issue from the moment the announcement was made. I have signed an executive order creating a Commission chaired by former Congressmen Tom Davis and Owen Pickett to strengthen and protect defense and national security infrastructure in Virginia.

In the remarks I made to you last January I also said this:

“The inherent dignity of a good day’s work in a worthwhile pursuit strengthens the soul, supports the family, and reduces dependence on government.”

And every Virginian deserves the opportunity of a good job, with good pay, in the community they call home. It’s good for our Commonwealth, and it ultimately is what will return Virginia to economic prosperity in the years ahead.

In the toughest economy since the Great Depression, with our national deficit at $1.6 trillion for the year and our national debt exploding to over $13 trillion, Virginians and Americans are looking at how things are done in the Commonwealth, and they see that there is another way forward. We should not hesitate to tell the story of Virginia’s balanced budget and spending restraint, and to encourage our federal government to learn from our bipartisan effort.

In this complicated, interconnected world it can often appear that the future is out of our hands. It is not. The steps we take in Richmond will determine the path Virginia takes coming out of this economic downturn. When we look back on this difficult period in our history, we will want people to know that we didn’t look to the next day; we looked to the next generation.

My goal is that we continue to put in place the policies that encourage job creation, investment, innovation, education, ingenuity, and good citizenship, and that is why Virginia will continue to help lead the nation in our economic recovery.

Thank you for your service to the people of Virginia.

###